reading time ~13mins

Video notes from IFG How to build a Halal Portfolio

Book Reference Halal Investing for Beginners

- Introduction

- Get your Financial foundations in Order

- Know your why – Keep the end goal in mind

- Think long term and be Patient

- Understand the Risk and Diversification

- Due Diligence

- Discipline and Avoiding emotional decisions

- Where to Invest

- How to create a portfolio

- Example Scenarios

- Rebalancing

- Tax Efficiency

- Final Thoughts

- Steps

Introduction

- In Islam, we invest in things which are permissible and Ethical

- Halal investing is anything that avoids

- Usury / Interest (Riba)

- Excessive uncertainty (Gharar)

- Gambling (Maysir)

- Ethical Investing – stay away from non-ethical, harmful and exploitative industries

- Alcohol

- Gambling

- Pork

- Arms

- Pornography, etc

- Halal will avoid

- Conventional Banks

- Companies that make money in haram ways

- Standard Bonds

- Finer Rules

- You cannot sell what you do not own

- You cannot have two conflicting contracts

- Islam encourages us to grow our wealth responsibly without compromising our faith

Get your Financial foundations in Order

- Pay off any debts especially interest based

- Build an emergency Fund – 3-6 months of Living expenses in Cash in a halal savings account. This is a safety net

- Ensure liquidity for Zakat payments

- Set up your will

Know your why – Keep the end goal in mind

- Why am I investing?

- What is the amount of money I am aiming to get to?

- What is my risk appetite?

Think long term and be Patient

- Get rich slowly and surely with compounding

- Compounding requires reinvesting your gains and not drawing them out

- Compounding is the 8th wonder of the world

- Do not think in days or months, but years and decades. Do not panic during short periods of recession

Understand the Risk and Diversification

- Higher risk – higher the return and vice versa

- Understand your risk appetite – know yourself

- Diversify across platforms, countries, securities, etc

- We are living in the end of an economic cycle, a new world order is forming with BRICS. This is a volatile world, and requires diversification

- Stocks, Properties, Sukuks, etc.. Also within these diversify further across regions, types, funds, etc

Due Diligence

- First for Sharia Compliance

- Secondly the basic fundamentals of the security you are investing it

Discipline and Avoiding emotional decisions

- Be wary of Fear and Greed

- Do not panic sell in falling markets

- Do not FOMO buy in bullish markets

- Consistency beats timing the market

Where to Invest

Anything of value, which is halal and appreciates in value and/or generates a passive income is worth investing in

- Stocks and Shares

- Buying an ownership in a company

- Stocks are halal as long as company’s business is halal

- Sharia standards say (based on Ijtihad)

- Company should not have more than 5% of revenue of the company coming from haram sources

- Debt should be below 30% of market value of the company

- There are islamic indices that do this for you

- Musaffa and Zoya

- DIY Stock Investing

- Individually pick stocks and invest in them

- This is the riskiest way to pick stocks

- It’s not easy

- Mutual Funds and ETFs

- Instant diversification

- Amal invest and Zoya plug into your own stock broker and remove the haram companies

- Roboadvisers – Wahed, Sarwa, Simply Ethical, Sharia Portfolio global, Saturna Amana Funds

- Tell them the risk appetite, they will create a portfolio of funds which are balanced

- Pension Funds

- Check if there is a halal option available. Many employers may offer an islamic fund as a choice

- Sukuk – Low Risk

- Islamic Bonds – Steady fixed income without using interest

- You do not lend money for interest. You buy a certificate that represents ownership in an asset – the income of profit from that asset is what you get in return

- The initial investment (principle) is being returned after a certain period of time

- Sukuk Funds are also there that group together a bunch of sukuks

- Private Investments

- There are other opportunities outside of the stock markets which are private such as real estate or Income Funds

- Peer to Peer Platforms

- People who need money connected to Investors

- Examples are nester, qardus or funding souq

- Islamic Bank savings account

- Profit share from their sharia compliant ventures

- Very low risk and very low return

- Good for emergency funds

- Do not put too much in there

- Real Estate

- Tangible and familiar investment

- Generally halal if not used for haram purposes

- Financing for buying should also be halal. Mortgage should be Islamic

- Rental income is halal as long as business the tenant is running is also halal

- Usually stable and long term investment. Generates rent and potential growth of property value over time

- Selling is hard and managing it requires some work

- Taxes are also targeting landlords in some countries

- Usually requires a large amount of money

- There are ways to do this in small amounts using listed funds like REITs. Some REITs are halal, but not always. Many of them may have a lot of debt

- REIT is a hybrid between real estate and stocks – more liquid but a bit more due diligence is required

- Real estate crowd funding platforms – chip in as a crowd a sum of money, and together each buy a property together. You get your share of rental profit. The platform and deal structures need due diligence. Examples are SmartCrowd, getStake or Yielders

- Cur8 Capital is a private fund which invests in a basket of real estate

- Business Investments which are not on the public stock market

- Startups

- Private Equity

- Venture Capital

- These are not on the public market but they have high growth potential. Impact is also big

- This is high risk, because many small businesses fail

- Invest in multiple businesses

- It requires you lock in your money for a long while – until the company is either bought by another giant (Acquisition), becomes a publicly listed company (IPO Initial Public Offering) or recapitalised (remains private but gains capital to scale)

- Ensure that these companies are operating in halal activities

- Private Equity

- Usually financed by Brick and Mortar businesses like a pharmacy, hair dressers, etc

- Examples are Wahed Ventures, HASAN.VC and Cur8 Capital

- There are also several muslim tech communities conferences where you could find founders and businesses that could be interesting. Events like Deen Developers, Muslamic Makers, Muslim Tech Fest or Alif Summit

- It’s harder to find good opportunities, there is a lot of due diligence required

- Gold and Commodities

- Gold is seen as a safe haven

- It does not generate passive income

- There are some conditions

- The transaction has to be spot – pay fully and take ownership right away

- You cannot buy it on margin or a deferred payment plan

- You can buy online, as long as it is owned

- Investments accounts and ETFs are also backed 100% physically

- ETF like GLD which are fully physically backed

- Best options in commodities are gold and silver either direct or via halal ETFs

- There are other commodities which are also possible like wheat, etc, however many times these are traded using instruments which are not halal such as futures and options

- Futures and Options are problematic because of leverage and deferred terms or selling something you do not own

- Alternative Assets

- Art, Vintage Cars, etc. Just ensure that those things are halal

- Crypto Currency

- New and controversial asset class

- Is bitcoin halal? Many scholars have said that major crypto currencies can be halal being digital assets as long as they are not used for haram activities. Other scholars are not comfortable and cite its speculative nature and lack of intrinsic value. There isn’t a unanimous verdict from the scholars

- From a practical perspective it is extremely volatile and you should be willing to lose your investment

- Screen cryptocurrencies for Islamic permissibility

- Avoid shady alt coins or interest based lending platforms in the crypto world

You can choose and diversify in all of these, just be aware of the risks. Develop a portfolio slowly by understanding these asset classes progressively

How to create a portfolio

Things to keep in mind

- Risk Tolerance

- Time Horizons

- Goals

Modern Portfolio Theory

- Mixing asset classes give better risk return tradeoffs. Portfolio with low risk – low return and high risk – high return asset classes. Create a balance between risk and reward

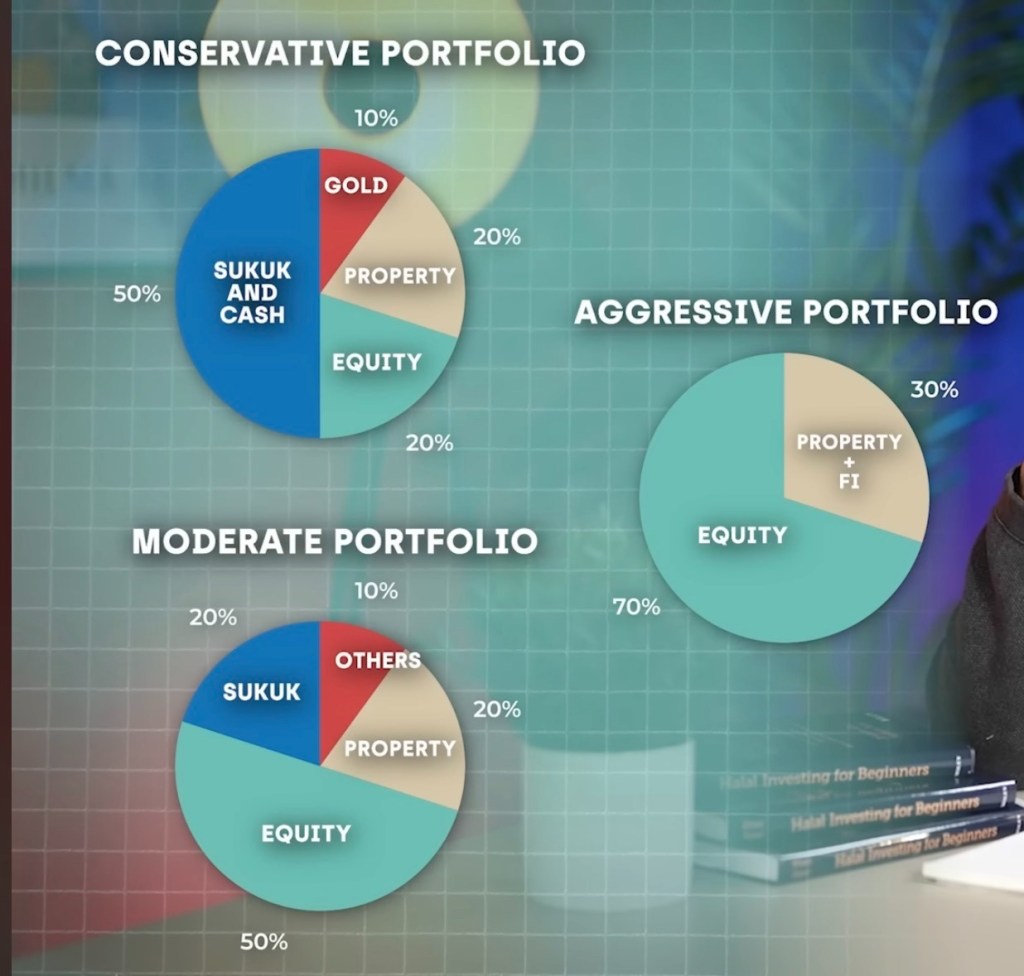

Examples of Portfolios

Example Scenarios

The scenarios described below are for illustrative and educational purposes only. They do not constitute financial advice. Please conduct your own research or consult a qualified financial professional before making any investment decisions

60 year old man

Goal: Capital Preservation and income generation for retirement. Conservative

- 20% Stocks

- 50% Sukuk and Islamic Fixed income funds

- 20% Real Estate

- 10% Cash or Near-Cash (for emergencies) – Safety Net

35 year old employee

Balanced with medium to long term goals

- 50% Stocks and Equity (high growth and conservative). Islamic index funds or ETFs

- 20% Sukuks

- 20% Real Estate

- 10% Cash or Gold

Add to the portfolio regularly with salary income. Split across the categories as well

If a house need to be bought, it can be stored as a separate saving

25 year old

Aggressive investor – less savings

- 70% Equities and Stocks which are growth and high risk

- 10% Real estate

- 10% Sukuks

- 10% speculative e.g.

- 5% Crypto

- 5% Startup Equity

- could multiply or goto zero

Learn as you grow

The entire portfolio may grow and fall significantly

Keep investing at regular intervals with salary

Over time as he gets older, he needs to adjust the portfolio for less risky options

Rebalancing

Adjust back your portfolio to your targets over time to ensure that your diversification still matches your goals. Usually you can do this once or twice a year

Tax Efficiency

Some instruments give tax benefits. E.g. In UK there are Individual savings account (ISA) where tax free 20k grows tax free

Less Tax = More Growth

Make sure to do this legally

Final Thoughts

- Take action – even if it is small. Benefits come from actions

- Stay educated and surround yourself with right people and knowledge resources

- Be patient and trust the process. Tie your camel and have Tawakkul. The outcome is from Allah

Make sure to pay Zakah and remove any impure income that sneaks in like interest

Steps

- Open account in a platform

- Start with one investment – something simple. E.g. an islamic global index or sukuk

- Set up a routine – how often and how much will you invest

- Invest a fixed amount with every paycheck. This is called Dollar cost averaging

- Adjust the portfolio – every quarter or so

- Also review your emotions and manage yourself

The end goal is to gain financial independence and growth in a way that is pleasing to Allah and beneficial to our lives. It is possible with patience and perseverance